The Complete Guide to ASC 842 Lease Accounting Compliance

Master lease accounting compliance with comprehensive insights, practical examples, and expert guidance for finance professionals

ASC 842 Lease Accounting Guide Introduction

Lease accounting is a critical area of finance that deals with the proper recognition, measurement, and reporting of lease transactions in financial statements. This comprehensive guide focuses on the lessee perspective and covers key concepts, standards, and practical examples to provide a thorough understanding of ASC 842 lease accounting. For additional resources and expert insights, visit our comprehensive lease accounting knowledge base.

What You'll Learn:

- ✅ Fundamental leasing concepts and terminology

- ✅ ASC 842 standards and compliance requirements

- ✅ Practical implementation examples and journal entries

- ✅ Business impact and strategic considerations

Understanding Lease Fundamentals for ASC 842 Compliance

Leasing constitutes a formal agreement wherein the owner of an asset, known as the lessor, grants permission to another entity, referred to as the lessee, to use that particular asset. This arrangement is not for an indefinite period but is bound by a predetermined timeframe that both parties agree upon.

Key Components of a Lease:

- Asset Usage Rights: Lessee gains temporary control over machinery, vehicles, property, or equipment

- Payment Structure: Periodic compensation (monthly, quarterly, or annually)

- Contract Terms: Specific conditions regarding duration, payments, maintenance, and asset return

- Benefits: Lessee avoids substantial upfront costs, lessor maintains ownership and steady income

Learn More: For detailed lease analysis techniques, see our guide on lease analysis fundamentals.

Pros of Leasing

Leasing presents several distinct advantages for businesses across various industries, allowing them to preserve capital, maintain flexibility, and benefit from certain tax advantages.

Capital Preservation

Leasing allows companies to maintain liquidity rather than investing heavily in assets. Startups can lease computers and servers instead of large upfront purchases, preserving capital for R&D, marketing, or workforce expansion.

Flexibility

Leasing offers unparalleled flexibility, especially beneficial in industries with rapid technological advancements or fluctuating demand patterns.

Tax Benefits

Lease payments are often considered operating expenses and can be tax-deductible, reducing taxable income more immediately than asset depreciation.

Cons of Leasing

While leasing offers several benefits, it also comes with disadvantages that companies must carefully consider.

Higher Long-Term Cost

Over extended periods, leasing costs can exceed outright purchase expenses. Companies miss out on residual asset value and may pay more in total lease payments.

Contractual Obligations

Lease agreements often include restrictive stipulations that can limit operational flexibility and adaptability.

Key Takeaway: Companies must thoroughly review and negotiate lease terms to ensure alignment with financial planning and operational strategies, weighing long-term costs against immediate benefits. For strategic lease optimization tips, read our article on 10 ways to optimize your lease portfolio.

What is a Lease?

A lease is a contractual agreement that forms a vital part of the business and financial landscape. It is a transaction structured around the concept of renting, where the lessor grants the lessee the right to use a tangible or intangible asset for a predetermined duration. For a comprehensive understanding of lease fundamentals, explore our introduction to lease accounting guide.

Lease Agreement Components

Duration

Predetermined lease term with specific start and end dates

Payment Structure

Amount, frequency, and timing of lease payments

Responsibilities

Maintenance, insurance, and operational obligations

Options

Renewal, termination, and purchase clauses

Types of Assets in Leasing

Real Estate Lease

Retail spaces, offices, warehouses. Example: Store leasing mall space with specific operational conditions and multi-year terms.

Vehicle Lease

Cars, trucks, fleet vehicles. Typically 2-4 year terms with mileage limits and return condition requirements.

Equipment Lease

Heavy machinery, construction equipment. Project-specific durations with maintenance responsibilities and purchase options.

Technology Lease

Computer systems, servers, software. Often includes upgrade clauses for latest technology access.

Oil & Gas Lease

Exploration and extraction rights. Significant upfront payments with complex royalty arrangements.

Land Lease

Agricultural, commercial, renewable energy use. Can span decades with significant financial statement impact.

Key Insight: Leases are tailored to specific needs of both parties and must be recorded in a manner that accurately reflects their impact on financial statements, ensuring transparency and compliance with relevant accounting standards.

Roles in Leasing

In a lease agreement, the roles of the lessee and lessor are distinct and carry different financial and legal implications.

Lessee

The lessee is the party that gains the right to use an asset for a specific period in exchange for making lease payments to the lessor. The lessee does not own the asset but has control over it for the lease term. From an accounting perspective, the lessee must record the lease on their financial statements, which can vary depending on whether it's an operating lease or a finance lease. For detailed guidance on proper lease classification, see our comprehensive article on how to classify leases correctly under ASC 842.

Example of a Lessee: A logistics company, Speedy Deliveries, requires a new fleet of delivery vans. Instead of purchasing them, Speedy Deliveries enters into a lease agreement to use these vans for five years. As the lessee, Speedy Deliveries records the vans as right-of-use assets and a corresponding lease liability on its balance sheet.

Lessor

The lessor is the party that owns the asset and provides it to the lessee for use. The lessor retains ownership of the asset and recognizes income from the lease payments received. Depending on the type of lease, the lessor accounts for the leased asset either as a sale, financing, or an owned asset (in the case of operating leases).

Example of a Lessor: Consider Real Estate Inc., a company that owns commercial buildings. It leases office space to various businesses. Real Estate Inc., as the lessor, continues to have the office spaces on its balance sheet as assets and recognizes lease income over the period of the lease agreements.

Comparison Between Lessee and Lessor

- Ownership vs. Right to Use: The lessor retains ownership of the leased asset, while the lessee obtains the right to use the asset without owning it.

- Financial Statement Impact: The lessor records lease income and maintains the asset on their balance sheet. The lessee records a right-of-use asset and related lease liability.

- Risks and Rewards: The lessor bears the residual risks of ownership, such as depreciation and obsolescence, while the lessee typically benefits from the use without the risks associated with ownership.

- Tax Treatment: The lessor may claim tax deductions for depreciation on the asset, while the lessee may be able to deduct lease payments as an expense.

- Capital Outlay: The lessor may have significant capital tied up in the assets, whereas the lessee typically does not have to commit large amounts of capital upfront. Examples in Contrast:

- A coffee shop (lessee) leases a commercial espresso machine from Kitchen Equipment Ltd. (lessor). The coffee shop uses the machine for its daily operations, paying a monthly fee, but does not own the machine.

- A freelance graphic designer (lessee) leases a high-end computer from Tech Leasing Co. (lessor) to handle intensive design work. The designer uses the computer in exchange for regular payments but will return it at the end of the lease term or renew the lease.

The lessor and lessee serve different functions within a lease agreement, each with its own set of responsibilities and financial considerations. The lessor acts as the owner and financier, while the lessee benefits from the use of the asset without the burdens of ownership.

What is Lease Accounting?

Lease accounting is a specialized field within financial accounting that pertains to recording and managing the financial implications of lease agreements. Under accounting standards, these principles determine how lease transactions are reflected on a company’s financial statements, primarily the balance sheet and income statement.

Why is Lease Accounting Important?

Lease accounting plays a pivotal role in the management and communication of a company's financial information. Here's an expanded explanation of its importance:

Transparency and Accuracy

Proper lease accounting ensures that the financial position of a company is transparent to all stakeholders, including investors, creditors, and management. Accurate reflection of leasing obligations means that a company's liabilities and assets are fully disclosed on the balance sheet, and the expenses related to these leases are properly recognized on the income statement. This transparency helps stakeholders understand the company's true financial health and obligations.

Financial Statement Analysis

Comparability in financial statements is essential for analysts and investors who look across different companies to make investment decisions. Lease accounting standards like ASC 842 level the playing field by ensuring that all companies account for leases in a similar way, whether they lease assets or buy them outright. This comparability makes it easier to assess a company's performance relative to its peers.

Risk Assessment

Understanding the risks associated with lease agreements is critical for risk management. Proper lease accounting allows a company to identify and quantify the obligations that may affect its cash flow and profitability. For example, long-term leases locked in at high rates may pose a risk if market rates fall. Conversely, variable lease payments linked to an index or rate could introduce variability in expenses.

Contract Management

Effective lease accounting practices require a thorough understanding of lease agreements, which can lead to better contract management. By understanding and tracking the terms of leases, companies can avoid the pitfalls of automatic renewals that may not be favorable, or they can negotiate better terms at renewal time.

Regulatory Compliance

Adherence to lease accounting standards is not optional; it is a legal and regulatory requirement. Failure to comply can result in penalties, damaged credibility, and a loss of investor confidence. Accurate lease accounting ensures that a company meets its reporting obligations and adheres to the highest standards of corporate governance.

Enhanced Decision Making

Accurate and timely lease records provide critical information that supports strategic decision-making. Management needs to know the full extent of the company's lease commitments to make informed decisions about capital investments, business expansions, and strategic initiatives. Knowing the impact of lease obligations on financial ratios also informs decisions related to financing and capital structure. For detailed analysis of ASC 842's impact on key metrics, see our article on how ASC 842 impacts key financial ratios and leasing strategies.

Lease accounting is more than a mere compliance exercise—it provides valuable insights into a company’s financial commitments, supports risk management, enhances transparency for decision-making, and enables stakeholders to make better-informed decisions. It is a critical aspect of financial reporting that affects a company's strategic planning and day-to-day operations.

What is Topic ASC 842 in Lease Accounting?

ASC 842, which stands for Accounting Standards Codification Topic 842, is the Financial Accounting Standards Board (FASB) standard on lease accounting that replaced the previous US GAAP standard, ASC 840. This standard significantly changes how entities account for leasing arrangements and came into effect for public companies for fiscal years beginning after December 15, 2018, and for private companies for fiscal years beginning after December 15, 2021. To avoid common implementation pitfalls, review our guide on 10 common ASC 842 lease accounting mistakes to avoid.

Comparing the ASC 840 vs. ASC 842 Standards

ASC 840 and ASC 842 are accounting standards issued by the Financial Accounting Standards Board (FASB) for lease accounting. ASC 842 is the updated standard that replaces ASC 840. The update brought significant changes to how companies account for leases, with a major impact on the treatment of operating leases. Here's a comparison of the two standards:

ASC 840 - Old Lease Accounting Standard

Under ASC 840, leases were classified as either capital leases or operating leases based on certain criteria (the risks and rewards of ownership).

ASC 842 - New Lease Accounting Standard

ASC 842 was introduced to address the lack of transparency of lease obligations under ASC 840. ASC 842 closes a major accounting loophole from ASC 840: off-balance-sheet operating leases. It requires that lessees record nearly all leases on the balance sheet. Leases are recognized as right-of-use assets and corresponding lease liabilities. This change provides a more accurate picture of an entity's leasing obligations.

The key changes include:

| ASC 840 - Old Lease Accounting Standard | ASC 842 - New Lease Accounting Standard | |

|---|---|---|

| Capital Lease | If a lease met any one of the specific criteria, it was classified as a capital lease, requiring the lessee to recognize a leased asset and a lease liability on the balance sheet, similar to if the asset was purchased with a loan. | The treatment of what were previously known as capital leases (now finance leases) remains substantially similar to ASC 840, but with changes to the classification criteria and disclosures. |

| Operating Leases | Did not require the recognition of lease assets or lease liabilities on the balance sheet. Lease expenses were recognized on a straight-line basis over the lease term, and only the lease commitment details were disclosed in the notes to the financial statements. | Lessees must recognize most leases on the balance sheet. This is done by recognizing a right-of-use asset and a corresponding lease liability for the obligation to make lease payments. |

| Short-Term Leases | Not capitalized under ASC 840. Lessees did not record an asset or a liability on the balance sheet for these leases. Instead, lessees recognized lease payments associated with short-term leases as rental expense on a straight-line basis over the lease term, within the income statement. | Lessees can elect not to recognize assets and liabilities for leases with a term of 12 months or less, provided there is no purchase option that the lessee is reasonably certain to exercise. |

Here's a matrix that compares the old and new lease accounting standards, ASC 840 and ASC 842, across four different criteria. This visual comparison should help in understanding the evolution from ASC 840 to ASC 842 and how the treatment of leases has changed, particularly in terms of balance sheet recognition, lease classification, treatment of short-term leases, and disclosure requirements. The matrix underscores the shift towards increased transparency and detail in financial reporting concerning leasing activities.

| ASC 840 (Old) | ASC 842 (New) | |

|---|---|---|

| Balance Sheet Recognition | Operating leases off-balance sheet | Operating leases on-balance sheet |

| Lease Classification | Capital & Operating Leases | Finance & Operating Leases (more extensive guidance) |

| Short-term Leases | Excluded from the balance sheet if less than 12 months | Option for non-recognition on the balance sheet if less than 12 months |

| Expanded Disclosures | Limited disclosures in notes | Extensive quantitative and qualitative disclosures |

Summary of Changes

Financial Reporting

- Balance Sheet: Under ASC 842, companies see an increase in assets and liabilities, which can affect financial ratios and debt covenants. Learn more about specific impacts in our articles on ASC 842 impacts on loan covenants and ASC 842 impacts on financial ratios and covenants. Both types of leases require the following on the balance sheet:

- - Right-of-Use Asset: This is an asset that represents the lessee's right to use the underlying asset for the lease term.

- - Lease Liability: This is a liability that represents the lessee's obligation to make lease payments arising from the lease.

- Income Statement: Operating lease expenses remain similar, but the timing and classification of expenses for finance leases may change.

- - Finance Leases: Interest on the lease liability and amortization of the right-of-use asset are recognized separately on the income statement.

- - Operating Leases: A single lease expense is recognized on a straight-line basis over the lease term.

- Cash Flow Statement: Operating cash flows may improve under ASC 842 due to the reclassification of the principal portion of finance lease payments from operating to financing activities.

- - Finance Leases: Cash paid for the principal portion is classified within financing activities, while cash paid for interest can be classified within operating or financing activities.

- - Operating Leases: Cash paid is classified as an operating activity.

- Disclosures: ASC 842 requires extensive qualitative and quantitative disclosures including, but not limited to:

- - General description of leasing arrangements.

- - Information about significant assumptions and judgments made in applying ASC 842.

- - Amounts recognized in the financial statements related to leases.

- - Information about the timing and amount of cash flows arising from leases.

Classifying Leases Under the ASC 842

Lease accounting requires careful consideration of several factors to determine the classification of each lease and the appropriate accounting treatment. The process ensures that the financial statements of both lessors and lessees fairly and accurately reflect the economic substance of the leasing transactions they enter.

In lease accounting, different types of leases are accounted for in varying ways according to standards set by the Financial Accounting Standards Board (FASB). Here's an expanded view of the primary types of leases under ASC 842 and their accounting implications,

Operating Lease. Under an operating lease, the lessee does not assume the risks and rewards of ownership. Instead, lease payments are treated as rental expenses, appearing on the income statement without affecting the balance sheet substantially under the previous accounting standards. However, under the ASC 842 standard, lessees are now required to recognize a right-of-use asset and a lease liability on the balance sheet for most operating leases.

Example: A retail clothing store leases space in a mall. The store records the lease payments as rental expenses on its income statement each month and, under the new standards, also includes a right-of-use asset and a corresponding liability on the balance sheet.

Finance Lease. If a lease is classified as a finance (or capital) lease, it implies that the lessee effectively obtains control over the asset and recognizes it on the balance sheet along with a corresponding liability. This type of lease is typically used for long-term leases that transfer the benefits and risks of ownership to the lessee.

Example: A transportation company might enter into a finance lease for a new fleet of trucks. On its balance sheet, the company would recognize the trucks as assets and the lease obligations as liabilities, while also amortizing the asset and recognizing interest expense on the liability over the lease term.

Short-Term Lease. Short-term leases are those with a lease term of 12 months or less. These leases do not require the recognition of a right-of-use asset or lease liability on the balance sheet, provided there is no purchase option that the lessee is reasonably certain to exercise.

Example: A consulting firm leases a temporary office space for 6 months while their main office is being renovated. The firm accounts for the lease payments as an expense over the lease term, without recognizing an asset or liability on the balance sheet.

The classification of a lease affects how it is reported in financial statements and can have significant implications for a company's financial ratios, borrowing capacity, and earnings report. Proper classification and accounting for leases are critical for transparency and compliance.

Lease Classification Criteria Explained

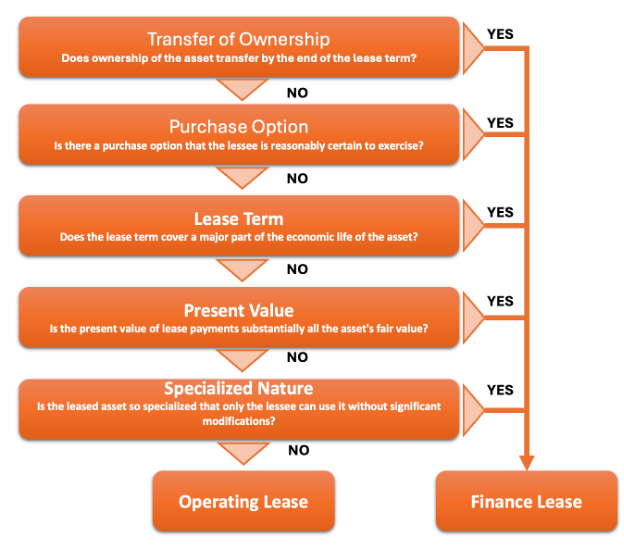

Under ASC 842 standards, the lease classification hinges on the extent to which the risks and rewards of ownership of the asset are transferred from the lessor to the lessee. The five criteria for lease classification are designed to make this determination:

1. Transfer of Ownership

Does ownership of the asset transfer by the end of the lease term?

This criterion examines whether the lease agreement includes a provision for the transfer of ownership of the asset to the lessee by the end of the lease term. If such a provision exists and is reasonably certain to be executed, the lease is typically classified as a finance lease.

Example: A company leases a piece of equipment with a clause that ownership will transfer to the company at the end of a 7-year lease term for no additional cost. This lease would be classified as a finance lease because it results in the transfer of ownership.

2. Purchase Option

Is there a purchase option that the lessee is reasonably certain to exercise?

The presence of a purchase option – that is, the lessee’s right to purchase the leased asset at a price that is expected to be sufficiently lower than the fair value at the date the option becomes exercisable – can result in a finance lease classification if the lessee is reasonably certain to exercise this option.

Example: A lease includes an option for the lessee to purchase the asset at the end of the lease term for a nominal amount. The lessee plans to exercise this option given the asset's strategic importance. Hence, the lease would be classified as a finance lease.

3. Lease Term:

Does the lease term cover a major part of the economic life of the asset?

If the lease term covers most of the economic life of the asset (even if title is not transferred), this typically indicates that the lease is a finance lease, as the lessee has control over the asset for most of its useful life.

Example: A company leases a machine for 8 years, and the machine has an economic life of 10 years. The lease term covers 80% of the economic life of the asset, suggesting a finance lease.

4. Present Value

Is the present value of lease payments substantially all the asset's fair value?

When the present value of the minimum lease payments amounts to substantially all the fair value of the leased asset, it is an indicator that the lease is a finance lease. This scenario implies that the lessee is assuming almost all the risks and rewards of ownership.

Example: If the present value of all lease payments for a car lease is equal to 90% of the car's market value, this would likely lead to a finance lease classification.

5. Specialization:

Is the leased asset so specialized that only the lessee can use it without significant modifications?

If the leased asset is of such a specialized nature that only the lessee can use it without major modifications being made, it is generally classified as a finance lease. This is because the lessor is unlikely to have an alternative use for the asset at the end of the lease term, which means the lessee effectively controls the asset.

Example: A company leases a custom-built piece of factory equipment designed specifically for its manufacturing process. This would be classified as a finance lease due to the asset’s specialized nature.

Here's a flowchart depicting the decision-making process for classifying a lease.

The analysis of these criteria requires judgment and consideration of the terms and conditions of the lease. The implications of classifying a lease as finance or operating are significant, affecting a company’s balance sheet, income statement, cash flows, and financial ratios. It is important for companies to carefully assess each lease against these criteria to ensure compliance with the applicable accounting standards.

Recognizing an Embedded Lease

An embedded lease is a component within a larger contract that contains a lease arrangement, but it may not be explicitly identified as a lease in the contract itself. These embedded leases can often be overlooked because they are buried within contracts that are primarily for services or other purposes. Identifying an embedded lease is crucial for lease accounting because it requires the lessee to account for the lease component separately from the service component of the contract. Learn more about this important topic in our detailed article on ASC 842 changes in identification of embedded leases.

According to accounting standards like the ASC 842, an embedded lease exists when a contract conveys the right to control the use of an identified asset for a period in exchange for consideration. To control the use of the asset, the customer must have both:

- The right to obtain substantially all the economic benefits from the use of the asset.

- The right to direct the use of the asset.

Example of an Embedded Lease

Service Contract with Equipment: A company enters into a service agreement with a supplier to provide and operate a printing machine for the company's office. While the contract is principally for printing services, the use of the machine is dedicated to the company for the contract's term. The specific printer is identified, and the company decides when and how to use the printer and is entitled to all the output it produces. In this case, the contract contains an embedded lease for the printer.

Accounting for an Embedded Lease

Once an embedded lease is identified, the lessee and lessor must account for the lease component separately from the service component, in accordance with the relevant lease accounting standard.

- - Lessee: The lessee would recognize a right-of-use asset and a lease liability on the balance sheet for the lease component, like other leases. The service component would be accounted for as an executory contract.

- - Lessor: The lessor accounts for the lease component according to whether it is a finance lease or an operating lease, and the service component is recognized as revenue over the period services are rendered.

Challenges

Identifying embedded leases can be challenging and requires a thorough review of contracts to ensure all lease components are properly accounted for. The difficulty lies in assessing whether an asset is specified and if the customer has the right to control its use.

Importance

Correctly identifying and accounting for all lease types is essential to ensure compliance with lease accounting standards, which can affect a company's financial metrics and statements. It impacts balance sheet liabilities and assets and can influence a company's debt covenants and financial ratios. It's also critical for transparency in financial reporting and can be a significant factor during audits. For comprehensive audit preparation guidance, review our article on auditing ASC 842 lease accounting compliance.

Transition and Complexity

The transition to ASC 842 is complex and requires significant effort, including:

- A complete review of all contracts to identify leases.

- Implementation of new lease accounting software or systems to manage the lease data.

- Recalculation of the lease liabilities and right-of-use assets for existing leases at the time of transition.

- Understanding the incremental borrowing rate to discount lease payments. For detailed IBR calculation guidance, see our comprehensive article on how to calculate IBR for ASC 842 compliance.

- Retraining staff and adjusting internal controls and processes to comply with the new standard.

The complexity of ASC 842 arises from the need to exercise judgment in determining whether a contract is or contains a lease, separating lease components from non-lease components, and determining the discount rate for leases. The standard also introduces complexities in areas such as sublease accounting, lease modifications, and sale-leaseback transactions. For guidance on handling lease modifications, see our article on ASC 842 lease modifications.

Companies transitioning to ASC 842 must ensure that their financial reporting reflects these changes and that they have the processes in place to maintain compliance going forward. This includes regular updates to lease information, calculations for lease renewals or terminations, and ongoing lease versus buy analysis.

ASC 842 Lease Accounting Effects on Business

The ASC 842 lease accounting standard has several effects on businesses in the United States, changing how they report leases in their financial statements and manage their lease portfolios.

Greater Transparency on Financial Leverage

Under the new standard, leases previously not reported on the balance sheet are now recognized as liabilities with corresponding right-of-use assets. This change gives a clearer picture of a company's financial obligations.

| Old | New | Business Impact |

|---|---|---|

| Companies could have significant off-balance-sheet lease obligations, making it challenging for stakeholders to ascertain the true level of a company's leverage. | With the right-of-use assets and lease liabilities on the balance sheet, stakeholders can better assess the impact of lease obligations on the company's financial health, including its liabilities and assets. | This transparency may affect a company's borrowing capacity, as lenders have a clearer view of its financial commitments. It can also influence lease versus buy decisions, as the visibility of lease liabilities might make purchasing assets more attractive. |

Enhancing Comparability Across Companies

The standardization of lease reporting means that all companies must follow the same rules for recognizing leases on their balance sheets, allowing for more accurate benchmarking and comparison.

| Old | New | Business Impact |

|---|---|---|

| Comparability was difficult because companies could choose how to classify and report their leases, leading to inconsistencies. | The standard provides a uniform framework, making it easier to compare financial statements across companies, as all leases with terms longer than 12 months will be accounted for in a similar fashion. | This can influence investment decisions as analysts and investors can make more informed comparisons of financial performance and position between companies within the same industry. |

Reflecting a More Accurate Financial Position

The balance sheet now includes lease liabilities and right-of-use assets that reflect future lease payments, presenting a more comprehensive view of a company's long-term financial commitments.

| Old | New | Business Impact |

|---|---|---|

| Many lease obligations were not visible on the balance sheet and were only disclosed in footnotes. | Recognizing these obligations on the balance sheet presents a completer and more accurate picture of a company's financial status. | This may affect a company's financial ratios, such as debt-to-equity and return on assets, which in turn can impact stock valuations, credit ratings, and compliance with debt covenants. |

Increased Administrative Burden

| Old | New | Business Impact |

|---|---|---|

| Companies typically did not need complex systems in place to track operating leases, as they were not recognized on the balance sheet. | The requirement to recognize all leases on the balance sheet necessitates detailed tracking and management of lease data, which can be substantial for companies with large lease portfolios. | Companies may need to invest in specialized lease accounting software, train staff on the new standards, and possibly hire additional resources to comply with the ongoing reporting requirements. |

Change in Key Performance Indicators (KPIs)

| Old | New | Business Impact |

|---|---|---|

| KPIs related to asset utilization and profitability did not take operating lease assets into account since they were off the balance sheet. | With right-of-use assets now on the balance sheet, KPIs such as asset turnover and return on assets will be affected. | Companies may see a change in how investors and analysts perceive performance, which could influence market valuations. |

Impact on Tax and Budgeting Processes

| Old | New | Business Impact |

|---|---|---|

| Tax and budgeting processes may not have fully considered the impact of all lease obligations due to their off-balance-sheet nature. | With a clearer picture of lease liabilities, tax planning and budgeting processes must account for the lease commitments, potentially changing how companies approach their tax strategies and budget allocations. | The changes could influence the timing of tax deductions related to leases and could also affect budgeting decisions and cash flow planning. |

Reassessment of Lease Versus Buy Decisions

| Old | New | Business Impact |

|---|---|---|

| Decisions to lease or buy an asset could be influenced by the desire to keep certain liabilities off the balance sheet. | With the requirement to recognize lease liabilities, the distinction between leasing and buying from a balance sheet perspective is minimized. | This may lead to a shift in strategy, with companies potentially opting to purchase assets rather than lease them if there is no longer a balance sheet advantage to leasing. |

Negotiation of Lease Terms

| Old | New | Business Impact |

|---|---|---|

| Companies might not have had as strong an incentive to negotiate certain lease terms when the leases were not capitalized. | Companies may seek to negotiate more favorable terms, such as shorter lease terms or more flexible exit clauses, to mitigate the balance sheet impact. | Negotiation dynamics between lessees and lessors could shift, potentially affecting market rates and the availability of certain lease arrangements. |

Cross-Border Lease Accounting Challenges

- - For Multinational Companies: These entities must navigate the differences between IFRS 16 and ASC 842, especially when preparing consolidated financial statements.

- - Business Impact: Multinational companies may face complexities in aligning their accounting policies across different jurisdictions, which could lead to increased costs and complexities in financial reporting.

While the new lease accounting standards aim to provide more accurate financial reporting, they bring a host of challenges and implications for businesses. These impacts extend to administrative practices, financial metrics, tax planning, capital expenditure strategies, lease negotiations, and even global accounting operations. Companies must evaluate all aspects of their leasing activities and may need to make strategic decisions to optimize their financial and operational performance under the new standards.

ASC 842 Lease Accounting – How To with Practical Examples

Amortization & Depreciation Schedules

Creating an amortization schedule involves outlining each periodic payment on a loan (in this case, a lease liability) over time. An amortization schedule shows the amounts going toward principal and interest and the remaining balance after each payment.

Finance Lease

Creating an amortization schedule for a finance lease under ASC 842 involves detailing how the lease liability is reduced over time through lease payments, and how the right-of-use (ROU) asset is depreciated.

The steps are as follows:

- 1. Gather Lease Information

- - Total initial value of the lease liability (the present value of future lease payments).

- - Payment frequency (monthly, quarterly, etc.).

- - Term of the lease.

- - The discount rate (either the rate implicit in the lease or the lessee's incremental borrowing rate).

- - The economic life of the asset.

- - Any initial direct costs or prepayments.

- - The expected residual value of the asset, if applicable.

- 2. Calculate Lease Payments

- 3. Set Up the Amortization Table

- 4. Calculate Interest Expense

- 5. Calculate Principal Repayment

- 6. Update Lease Liability

- 7. Depreciate the ROU Asset

- 8. Accumulate Depreciation

- 9. Repeat for Each Period

- 10. Adjust for the Residual Value

Start by collecting all necessary details of the lease agreement, including:

If the lease payments are not explicitly stated, calculate them based on the present value of future lease payments, the lease term, and the discount rate.

Create a table with columns for each period (date), beginning balance, lease payment, interest expense, reduction of lease liability (principal), ending lease liability, depreciation expense, and ending ROU asset balance.

For each period, multiply the beginning balance of the lease liability by the discount rate to find the interest expense.

Subtract the interest expense from the total lease payment to get the amount that will reduce the lease liability (principal repayment).

Subtract the principal repayment from the beginning balance of the lease liability to find the ending balance for that period.

Calculate the depreciation of the ROU asset, generally on a straight-line basis over the shorter of the lease term or the asset's useful life, unless there is a residual value guaranteed by the lessee. This becomes the depreciation expense for the period.

Keep a running total of accumulated depreciation, which is deducted from the initial value of the ROU asset to determine its book value over time.

Repeat steps 4 through 8 for each payment period until the lease liability is fully amortized, and the ROU asset is fully depreciated at the end of the lease term.

If there is a residual value that the lessee is responsible for at the end of the lease term, ensure that this value is accounted for in the final periods of the amortization schedule.

It is important to note that each entity may face unique considerations that affect the amortization schedule. The schedule should be reviewed regularly and adjusted for any changes due to lease modifications, reassessment of the lease term, or changes in the discount rate.

Operating Lease

Creating an amortization schedule for an operating lease under ASC 842 involves understanding how the lease expense is recognized and how the lease liability and right-of-use (ROU) asset are managed over the term of the lease. Unlike finance leases, where interest and depreciation are recognized separately, operating leases involve a single lease expense recognized on a straight-line basis.

Here’s how to create an amortization schedule for an operating lease:

1. Gather Lease Information

Start by collecting all necessary details of the lease agreement, including:

- Total initial measurement of the lease liability, which is the present value of future lease payments.

- Payment frequency (monthly, quarterly, etc.).

- Term of the lease.

- The discount rate (incremental borrowing rate if the rate implicit in the lease is not readily determinable).

- Any initial direct costs, lease incentives received, or initial payments made before or at the commencement date.

2. Calculate the Total Lease Expense

The total lease expense for the period of the lease is typically recognized on a straight-line basis. This means that the total cost of the lease (including any initial direct costs and subtracting any incentives) divided by the lease term will give the periodic lease expense.

3. Set Up the Amortization Table

Create a table with columns for each period (date), beginning lease liability, lease payment, interest expense (calculated on the liability), reduction of lease liability (principal), ending lease liability, and the ROU asset balance.

4. Calculate Interest Expense

For each period, multiply the beginning balance of the lease liability by the discount rate to determine the interest expense for that period.

5. Determine Lease Payment Reduction

Subtract the interest expense from the total lease payment to determine how much of the payment will reduce the lease liability.

6. Update Lease Liability

Subtract the lease payment reduction from the opening lease liability balance to get the closing lease liability balance for that period.

7. Calculate ROU Asset Amortization

The ROU asset is generally adjusted for the same lease expense amount recognized in the income statement, except adjusted for any interest on the lease liability and any impairment losses. The ROU asset starts with an initial value equal to the lease liability plus any initial direct costs less any lease incentives.

8. Accumulate Depreciation (Not Applicable)

In operating leases under ASC 842, the ROU asset is not depreciated separately but is reduced by the lease expense minus the interest cost on the liability.

9. Repeat for Each Period

Repeat steps 4 through 8 for each payment period until the lease ends. The lease liability and ROU asset should both reach zero by the end of the lease term if all calculations are done correctly.

10. Record Lease Expense

The lease expense recorded in the income statement should be consistent each period, reflecting the straight-line expense recognition rule.

Adjust for Any Modifications

If there are any modifications to the lease that change the payment amounts, the term, or other conditions, the lease liability and ROU asset should be recalculated, and the schedule updated accordingly.

This structured approach ensures that the financial statements accurately reflect the economic reality of operating lease commitments under ASC 842. The consistent expense recognition aligns with the performance of the asset over its useful life, providing a clear, transparent view of the lessee's financial commitments.

ASC 842 Compliant Journal Entries

As companies transition from ASC 840 to ASC 842, it is crucial to understand how existing lease-related general ledger accounts are defined under the old standard (ASC 840) and how they will be treated or transformed under the new standard (ASC 842).

ASC 840 Adjustment Journal Entries at Transition

1. Operating Accrued Rent Liability (ASC 840)

This liability account is used to record the difference between the rent expense recognized using the straight-line method and the actual rent payments made under the terms of the lease. This account typically accrues when the lease agreement includes escalating payments and the rent expense recognized on the income statement is more than the actual rent paid, especially in the early stages of the lease.

2. Operating Prepaid Rent Asset (ASC 840)

This asset account records rent payments made in advance that exceed the rent expense recognized in the current period. The prepaid rent is amortized over the period in which the rent relates, aligning the expense recognized with the benefit of the leased property use.

3. Operating Straight-line Rent Liability (ASC 840)

This liability account is utilized to manage the difference when the total rent expense recognized on a straight-line basis over the lease term is less than the actual lease payments made at the start of the lease term. This typically occurs when leases have initial rent-free periods or upfront incentive adjustments.

4. Capital Lease Gross ROU Asset (ASC 840)

In the context of ASC 840, which classifies leases as either operating or capital, this asset account for capital leases represents the right-of-use (ROU) asset recorded at the start of the lease. It includes the present value of future lease payments and is amortized over the lease term or the useful life of the asset, whichever is shorter.

5. Capital Lease Asset Accumulated Amortization (ASC 840)

This account tracks the accumulated amortization of the capital lease ROU asset. Amortization is recorded as an expense on the income statement and reduces the carrying amount of the ROU asset on the balance sheet over its useful life.

6. Capital Lease Liability (ASC 840)

This account represents the obligation to make future payments under a capital lease, discounted to present value. The liability is reduced as payments are made over the lease term, and interest expense is recognized based on the effective interest method.

Transition from ASC 840 to ASC 842:

- Operating Leases: Under ASC 842, all leases, including previous operating leases, will have a ROU asset and lease liability recognized, eliminating the concept of operating accrued rent liabilities and straight-line rent liabilities as previously managed.

- Capital Leases (Finance Leases under ASC 842): The treatment is similar, where a right-of-use asset and a lease liability are recognized, but all leases will now follow a unified approach under ASC 842, providing a more consistent framework compared to the dual model under ASC 840.

Under ASC 842, both operating and finance leases require the recognition of a right-of-use (ROU) asset and a lease liability on the balance sheet.

ASC 842 Operating Lease Journal Entries

Here are the definitions for the lease accounting journal entry accounts for Operating Leases under ASC 842:

1. Operating Accrued IDC Liability

This liability account records the interest costs incurred during the construction phase of an asset that are attributable to lease components. For operating leases under ASC 842, this liability would typically be less common unless the lease arrangement specifically involves the construction or customization of the leased asset.

2. Operating Deferred Lease Incentive Liability

This account records incentives provided by the lessor, such as tenant allowances or periods of free rent, which are recognized as a reduction of the ROU asset. The liability is amortized as a reduction of lease expense over the lease term.

3. Operating Gross ROU Asset

Represents the total right-of-use asset recognized at lease commencement, calculated as the present value of the lease payments, adjusted for any lease incentives, initial direct costs, and prepaid lease payments. This asset is amortized over the lease term, typically on a straight-line basis as part of lease expense.

4. Operating Initial Direct Cost Asset

This asset account captures all initial direct costs incurred by the lessee that are directly attributable to negotiating and arranging the operating lease, excluding general overhead costs. These costs are included in the initial measurement of the ROU asset and amortized over the lease term.

5. Operating Lease Liability

Represents the present value of the remaining lease payments, discounted using the lessee’s incremental borrowing rate or the rate implicit in the lease if readily determinable. This liability is increased by interest expense and decreased by lease payments over the lease term.

6. Operating Prepaid Lease Asset

This account records any lease payments made at or before the commencement date that exceed the lease liability. This prepaid amount is recognized as an expense over the lease term using a systematic and rational method.

7. Operating Rent Expense: Implied Interest

This expense account captures the interest component of lease payments under an operating lease, which is recognized using the effective interest method to amortize the lease liability.

8. Operating Rent Expense: Implied ROU Amortization

Reflects the amortization of the ROU asset associated with an operating lease, recognized as part of the straight-line total lease expense on the income statement, ensuring that the expense recognition matches the benefit derived from the lease.

9. Operating ROU Asset Accumulated Amortization

This account tracks the total amortization that has been recognized against the ROU asset over the lease term, reducing the book value of the asset on the balance sheet.

ASC 842 Finance Lease Journal Entries

Under ASC 842, finance leases (formerly known as capital leases under ASC 840) require lessees to recognize a right-of-use (ROU) asset and a lease liability on the balance sheet, similar to how fixed assets and their corresponding liabilities are recorded. The accounting treatment aims to reflect the economic ownership of the leased asset by the lessee.

Here are the definitions for the lease accounting journal entry accounts for Finance Leases under ASC 842:

1. Finance Accrued IDC Liability

This account records the interest costs that are capitalized (not expensed) during the construction or preparation phase of a finance lease asset. It is relevant when the lessee is involved in constructing or customizing the leased asset. The liability is typically amortized over the useful life of the underlying asset as part of the asset cost.

2. Finance Deferred Lease Incentive Liability

This liability account captures any incentives received from the lessor, such as tenant improvement allowances or periods of free rent, under a finance lease. These incentives are recognized initially as a reduction of the ROU asset and then amortized to reduce lease expense over the lease term.

3. Finance Gross ROU Asset

Represents the total ROU asset recognized at the commencement of a finance lease. This asset includes the present value of future lease payments and any initial direct costs incurred by the lessee. The asset is amortized over the shorter of the asset's useful life or the lease term.

4. Finance Initial Direct Cost Asset

Includes costs that are directly attributable to the negotiation and setup of a finance lease. These costs are capitalized as part of the ROU asset and amortized over the lease term to reflect their consumption as the asset is used.

5. Finance Lease Liability

This liability represents the present value of the future lease payments required under the finance lease, discounted using the lessee’s incremental borrowing rate or the interest rate implicit in the lease. This liability is reduced as payments are made and interest accrues.

6. Finance Prepaid Lease Asset

Records lease payments made in advance of their due date under a finance lease. These payments are initially recorded as an asset and then recognized as an expense (amortized) over the period that the payments pertain to.

7. Finance Interest Expense

This expense account records the cost of borrowing over the lease term for a finance lease. The interest expense is calculated on the lease liability using the effective interest method and is recognized in the income statement.

8. Finance ROU Asset Amortization Expense

Reflects the systematic amortization of the ROU asset associated with a finance lease, recognized over the useful life of the leased asset or the lease term, whichever is shorter.

9. Finance ROU Asset Accumulated Amortization

This account tracks the total amortization expense recognized against the ROU asset from the start of the lease to the reporting date, decreasing the book value of the ROU asset on the balance sheet.

10. Finance Owned Gross Asset

Represents the total value of assets owned under finance leases before depreciation. This account is used when the asset ownership is effectively transferred to the lessee, reflecting the asset's gross book value.

11. Finance Owned Asset Accumulated Depreciation

Records the cumulative depreciation of owned assets under finance leases. This account reduces the gross book value of the assets to their net book value and is recognized based on the depreciation method applicable to the asset type.

It's important to note that the specifics of these journal entries can vary depending on factors such as the payment timing (beginning vs end of period), variable lease payments, lease incentives, initial direct costs, and residual value guarantees. Additionally, lessees must maintain schedules to track future lease payments, the amortization of the ROU asset, and the accretion of interest on the lease liability, which are used to generate the necessary journal entries throughout the lease term.

Accurate journal entries under ASC 842 for both operating and finance leases will require the following data:

1. Lease Term: The non-cancellable period for which the lessee has the right to use the underlying asset.

2. Lease Payments: Payments made by the lessee to the lessor for the right to use the underlying asset during the lease term. This includes fixed payments, variable lease payments that depend on an index or rate, residual value guarantees, and the exercise price of a purchase option if reasonably certain to be exercised.

3. Initial Direct Costs: Incremental costs that would not have been incurred if the lease had not been executed (e.g., commissions or legal fees).

4. Discount Rate: The rate used to discount lease payments to present value. This will either be the rate implicit in the lease or, if that rate is not readily determinable, the lessee’s incremental borrowing rate (IBR).

5. Prepaid or Accrued Lease Payments: Any lease payments made before or at the commencement of the lease, or accrued lease payments that need to be accounted for.

6. Incentives Received: Any incentives to enter into the lease agreement, such as tenant allowances.

7. Residual Value Guarantees: The amount guaranteed by the lessee to the lessor for the residual value of the underlying asset at the end of the lease term.

Additional for Finance Leases:

1. Economic Life of the Asset: The total estimated useful life of the underlying asset.

2. Fair Value of the Asset: The value of the leased asset at the commencement date if it were to be purchased outright.

3. Amortization Schedule: This is required to determine the depreciation of the ROU asset for finance leases.

4. Interest Method: The method used to allocate the finance charge over the lease term.

With these data points, you can perform the following calculations and create the necessary journal entries:

Initial Recognition:

- Calculate the present value of the lease payments using the discount rate to determine the lease liability.

- Add any initial direct costs and prepayments and subtract lease incentives received to the lease liability to determine the ROU asset.

Subsequent Measurement:

For Operating Leases:

- Recognize a single lease expense on a straight-line basis over the lease term.

- Adjust the ROU asset and lease liability accordingly.

For Finance Leases:

- Separate the lease payment into the principal (which reduces the lease liability) and interest expense (based on the lease liability's carrying amount).

- Depreciate the ROU asset over the shorter of the lease term or the useful life of the asset.

Maintaining detailed schedules for the payment, amortization, and depreciation of leases is crucial for accuracy. This information should be reviewed and updated regularly for changes that could impact the lease accounting.

Lease Accounting in Action

Example: XYZ Corp. Enters a Finance Lease for Equipment

XYZ Corp. enters a lease agreement for a piece of manufacturing equipment over a 5-year term with annual payments of $100,000. This lease is classified as a finance lease because it meets the criteria for a finance lease under ASC 842, specifically the transfer of ownership at the end of the term.

XYZ Corp. will recognize both a right-of-use asset and a lease liability on its balance sheet for the present value of lease payments. The asset is amortized over the lease term, impacting the income statement with both amortization expense and interest expense on the liability.

Assumptions:

- Lease Term: 5 years

- Annual Lease Payment: $100,000

- Incremental Borrowing Rate (IBR): 5%

- Present Value of Lease Payments: This is calculated based on the lease payments discounted by the IBR.

Step 1: Calculate Present Value of Lease Liability

The present value of the lease payments is calculated by discounting each payment at the 5% incremental borrowing rate. We use the present value of an annuity formula:

PV = P × ( (1 - (1 + r)^-n) / r )

Where:

P= Annual Lease Payment ($100,000)r= Incremental Borrowing Rate (5% or 0.05)n= Lease Term (5 years)

Calculation:

PV = 100,000 × ( (1 - (1 + 0.05)^-5) / 0.05 ) = 100,000 × 3.791 = 379,100

The Present Value of Lease Liability is approximately $379,100.

Step 2: Initial Journal Entries for Recognition

At the start of the lease, XYZ Corp. recognizes the right-of-use asset and the lease liability:

Debit Right-of-Use Asset: $379,100

Credit Lease Liability: $379,100

Step 3: Annual Journal Entries and Amortization Schedule

Scenario 1: Asset’s Useful Life Equals the Lease Term (5 years)

Since the useful life and the lease term are both 5 years, the asset will be amortized on a straight-line basis over the lease term.

XYZ Corp. will also recognize interest on the lease liability, which decreases each year as the liability is paid down.

- Amortize the Right-of-Use Asset: 379,100 ÷ 5 = 75,820 per year.

- Interest Expense Calculation: Each year’s interest is calculated on the remaining lease liability at a 5% rate.

Amortization Schedule and Journal Entries for Scenario 1

| Year | Lease Liability Beginning Balance | Lease Payment | Interest Expense (5%) | Principal Reduction | Lease Liability Ending Balance |

|---|---|---|---|---|---|

| 1 | $379,100 | $100,000 | $18,955 | $81,045 | $298,055 |

| 2 | $298,055 | $100,000 | $14,903 | $85,097 | $212,958 |

| 3 | $212,958 | $100,000 | $10,648 | $89,352 | $123,606 |

| 4 | $123,606 | $100,000 | $6,180 | $93,820 | $29,786 |

| 5 | $29,786 | $100,000 | $1,489 | $98,511 | $0 |

For Lease Payment:

- Debit Lease Liability: Principal Reduction

- Debit Interest Expense: Interest for the Year

- Credit Cash: $100,000

For Amortization of Right-of-Use Asset:

- Debit Amortization Expense: $75,820

- Credit Right-of-Use Asset: $75,820

Scenario 2: Asset’s Useful Life Is Longer Than the Lease Term

If the asset's useful life extends beyond the lease term (for example, a 10-year useful life with a 5-year lease term), the amortization period changes depending on whether XYZ Corp. retains ownership at the end of the lease.

If XYZ Corp. Retains Ownership:

If ownership transfers to XYZ Corp. at the end of the lease, the right-of-use asset will be amortized over the 10-year useful life rather than the lease term.

Annual Amortization Expense: 379,100 ÷ 10 = 37,910

Journal Entries for Scenario 2 (Ownership Transfers)

For Lease Payment:

- Debit Lease Liability: Principal Reduction

- Debit Interest Expense: Interest for the Year

- Credit Cash: $100,000

For Amortization of Right-of-Use Asset:

- Debit Amortization Expense: $37,910

- Credit Right-of-Use Asset: $37,910

If XYZ Corp. Does Not Retain Ownership:

If ownership does not transfer to XYZ Corp., the right-of-use asset is amortized over the lease term (5 years) instead of the 10-year useful life, following the same schedule as in Scenario 1.

ASC 842 Lease Disclosure Report for XYZ Corp.

This report provides disclosures for the finance lease of manufacturing equipment under ASC 842, as required for XYZ Corp.’s financial statements. The lease commenced on January 1, 2024, with a 5-year term and annual lease payments of $100,000. The lease is classified as a finance lease as it meets the criteria under ASC 842 due to transfer of ownership at the end of the lease term.

Lease Terms and Conditions

- Lease Term: 5 years

- Annual Lease Payment: $100,000

- Incremental Borrowing Rate (IBR): 5%

- Total Present Value of Lease Payments (Lease Liability): $379,100

- Ownership Transfer: Yes, ownership will transfer to XYZ Corp. at the end of the lease term

- Asset Useful Life: 10 years

Right-of-Use Asset and Lease Liability

At lease commencement, XYZ Corp. recognized a right-of-use (ROU) asset and corresponding lease liability based on the present value of lease payments:

- Right-of-Use Asset: $379,100

- Lease Liability: $379,100

Amortization and Interest Expense

The right-of-use asset and lease liability are amortized over the lease term. The following table shows the amortization schedule and the breakdown of lease liability, interest expense, and amortization expense for each year:

| Year | Lease Liability Beginning Balance | Annual Lease Payment | Interest Expense (5%) | Principal Reduction | Lease Liability Ending Balance | Amortization Expense |

|---|---|---|---|---|---|---|

| 1 | $379,100 | $100,000 | $18,955 | $81,045 | $298,055 | $37,910 |

| 2 | $298,055 | $100,000 | $14,903 | $85,097 | $212,958 | $37,910 |

| 3 | $212,958 | $100,000 | $10,648 | $89,352 | $123,606 | $37,910 |

| 4 | $123,606 | $100,000 | $6,180 | $93,820 | $29,786 | $37,910 |

| 5 | $29,786 | $100,000 | $1,489 | $98,511 | $0 | $37,910 |

Total Lease Expense Recognition

The total lease expense for each year includes the interest expense on the lease liability and the amortization expense of the right-of-use asset. This results in the following total expense recognition over the 5-year term:

| Year | Interest Expense | Amortization Expense | Total Lease Expense |

|---|---|---|---|

| 1 | $18,955 | $37,910 | $56,865 |

| 2 | $14,903 | $37,910 | $52,813 |

| 3 | $10,648 | $37,910 | $48,558 |

| 4 | $6,180 | $37,910 | $44,090 |

| 5 | $1,489 | $37,910 | $39,399 |

Additional Disclosures

- Residual Value Guarantee: None

- Variable Lease Payments: None

- Short-Term Lease Exemption: Not applicable

- Significant Judgments: The determination of the incremental borrowing rate (IBR) at 5% was based on XYZ Corp.’s estimated borrowing rate for similar lease terms and risk profiles.

This concludes the ASC 842 Lease Disclosure for XYZ Corp.’s finance lease of manufacturing equipment.

Explanation of Each Section

1. Lease Overview

Purpose: To provide an introduction to the lease, including its terms, classification, and the criteria met for classification as a finance lease.

Importance: This section helps users understand the basic characteristics of the lease arrangement and the reason for its finance lease classification.

2. Right-of-Use Asset and Lease Liability

Purpose: To present the initial recognition values for both the right-of-use asset and the lease liability.

Importance: This initial recognition is crucial for stakeholders to understand the lease’s impact on the balance sheet.

3. Amortization and Interest Expense

Purpose: To detail the method and period over which the asset is amortized, as well as how interest expense is calculated.

Importance: This section clarifies how the lease affects the income statement through amortization and interest expenses, helping stakeholders anticipate future expenses.

4. Amortization Schedule

Purpose: To provide a detailed schedule showing annual amortization, interest expense, and reduction in lease liability.

Importance: This transparency enables users to understand how the lease liability will be paid down over time, impacting cash flows and liabilities.

5. Lease Maturity Analysis

Purpose: To present undiscounted lease payments broken down by year.

Importance: This helps stakeholders understand future cash outflows related to the lease, improving liquidity planning and risk assessment.

6. Total Lease Expense

Purpose: To summarize the total expense for the lease each year, including both amortization and interest.

Importance: This provides a comprehensive view of the cost impact on the income statement, supporting financial analysis and cost control.

Example: ABC Ltd Enters a Operating Lease for Real Estate

Consider ABC Ltd. which leases office space for five years. Under the new lease accounting standard, ABC Ltd. is required to recognize a right-of-use asset and a lease liability on its balance sheet, even though it is an operating lease. The expense recognition on the income statement will typically be on a straight-line basis, which means the same amount of expense is recognized each period throughout the lease term.

Under ASC 842, an operating lease does not transfer ownership of the underlying asset to the lessee. Instead, the lessee gains the right to use the asset for a period in exchange for making lease payments. The following are the typical journal entries associated with an operating lease under the new standard:

Step 1: Calculate the Present Value of Lease Liability

To calculate the present value (PV) of the lease liability, we discount the series of lease payments at the incremental borrowing rate (IBR) of 5%. The formula used is:

PV = PMT × [(1 - (1 + r)^-n) / r]

- PMT: $100,000 (annual payment)

- r: 5% (incremental borrowing rate)

- n: 5 years (lease term)

Calculation:

PV = 100,000 × 4.3295 = $432,950

Present Value of Lease Liability: $432,950

Step 2: Record Amortization of the Right-of-Use Asset

Since this is an operating lease, the ROU asset is amortized on a straight-line basis over the lease term.

Annual Lease Expense:

Total Lease Payments = $100,000 × 5 = $500,000

Annual Lease Expense = 500,000 / 5 = $100,000

Amortization Schedule

| Year | Beginning Lease Liability | Interest Expense (5%) | Lease Payment | Reduction in Liability | Ending Lease Liability | Annual Amortization |

|---|---|---|---|---|---|---|

| 1 | $432,950 | $21,648 | $100,000 | $78,352 | $354,598 | $78,352 |

| 2 | $354,598 | $17,730 | $100,000 | $82,270 | $272,328 | $82,270 |

| 3 | $272,328 | $13,616 | $100,000 | $86,384 | $185,944 | $86,384 |

| 4 | $185,944 | $9,297 | $100,000 | $90,703 | $95,241 | $90,703 |

| 5 | $95,241 | $4,762 | $100,000 | $95,238 | $0 | $95,238 |

Step 3: Journal Entries for Each Year

Initial Year Entry (Year 0):

- Debit: Right-of-Use Asset $432,950

- Credit: Lease Liability $432,950

Subsequent Years (Years 1-5):

Example Entry for Year 1:

- Debit: Lease Expense $100,000

- Credit: Accumulated Amortization – ROU Asset $78,352

- Credit: Lease Liability Interest Expense $21,648

Summary and Explanation of Lease Accounting for the 5-Year Lease

Under ASC 842, ABC Ltd. recognizes a lease liability and a right-of-use (ROU) asset for its five-year operating lease.

- Lease Liability and Right-of-Use Asset: Initial recognition of $432,950 as both a lease liability and ROU asset.

- Expense Recognition: ABC Ltd. incurs an annual lease expense of $100,000, with components of amortization and interest.

- Balance Sheet Implications: The ROU asset and lease liability decrease over the lease term.

- Income Statement Implications: The lease expense is recognized on a straight-line basis.

This approach under ASC 842 enhances financial transparency by bringing operating leases onto the balance sheet.

ABC Ltd. ASC 842 Lease Disclosure Report

1. Lease Summary

ABC Ltd. has entered into a lease agreement for office space with a lease term of five years, beginning January 1, 2024. The lease is classified as an operating lease under ASC 842. Annual lease payments are $100,000, and the incremental borrowing rate (IBR) is 5%.

2. Lease Costs

| Lease Cost Category | Amount (USD) |

|---|---|

| Operating Lease Cost | $100,000 per year |

| Short-term Lease Cost | $0 |

| Variable Lease Cost | $0 |

| Sublease Income | $0 |

| Total Lease Cost | $100,000 per year |

3. Right-of-Use (ROU) Asset and Lease Liability

| As of December 31, 2024 | Amount (USD) |

|---|---|

| Right-of-Use Asset | $432,950 |

| Lease Liability - Current | $78,352 |

| Lease Liability - Non-Current | $354,598 |

Note: The ROU asset and lease liability amounts are initially measured at the present value of lease payments over the lease term, discounted at the incremental borrowing rate of 5%.

4. Lease Maturity Analysis

| Year | Undiscounted Lease Payment (USD) | Present Value (USD) |

|---|---|---|

| 2024 | $100,000 | $95,238 |

| 2025 | $100,000 | $90,703 |

| 2026 | $100,000 | $86,384 |

| 2027 | $100,000 | $82,270 |

| 2028 | $100,000 | $78,352 |

| Total | $500,000 | $432,950 |

5. Weighted-Average Lease Term and Discount Rate

| Metric | Amount |

|---|---|

| Weighted-Average Remaining Lease Term (years) | 5 years |

| Weighted-Average Discount Rate | 5% |

6. Cash Flow Information

| Cash Flow Category | Amount (USD) |

|---|---|

| Operating Cash Outflows for Leases | $100,000 per year |

Explanation of Each Disclosure Section and Its Purpose

Description of Leases

Purpose: This section provides a qualitative overview of the types of leases the company has, their duration, renewal options, and general payment structures.

Importance: It gives users of the financial statements context regarding the nature of the company’s lease obligations, aiding in assessing operational flexibility and long-term obligations.

Lease Liabilities and Right-of-Use Assets

Purpose: This section quantifies the lease liability and ROU asset balances, separating short-term and long-term lease liabilities.

Importance: It shows the company’s commitment to lease payments as liabilities on the balance sheet and its usage rights of leased assets, providing insight into capital and asset structure.

Lease Expense

Purpose: This disclosure details the components of lease expenses, including operating lease expenses, short-term lease expenses, and variable lease expenses.

Importance: This helps investors and other stakeholders understand the impact of lease arrangements on the income statement, assessing how much expense relates to fixed versus variable leases, as well as expenses for short-term leases.

Maturity Analysis of Lease Liabilities

Purpose: This section provides the undiscounted future cash outflows for lease payments over the lease term, alongside the present value of lease liabilities.

Importance: The maturity analysis is critical for liquidity and risk analysis, helping stakeholders evaluate future cash requirements related to lease commitments, assess the timing of outflows, and understand the discounted liability.

Other Lease Disclosures

Purpose: This final section covers additional disclosures, including the discount rate, cash paid for lease liabilities, and methods of ROU asset amortization.

Importance: Each disclosure aids in understanding the assumptions and policies behind lease accounting, such as the discount rate, and gives insight into the company’s cash flows for lease obligations, helping to assess policy impacts on financials.

The ASC 842 disclosure report is vital for providing transparency into a company's lease-related liabilities, ROU assets, and lease expenses, which were not as visible in previous standards. It gives investors and analysts comprehensive insights into how leases impact the balance sheet, income statement, and cash flow, ultimately leading to more informed investment and lending decisions.

ASC 842 Short-Term Lease Accounting Treatment

Short-term leases are defined under ASC 842 as leases with a lease term of 12 months or less and do not include an option to purchase the underlying asset that the lessee is reasonably certain to exercise. For such leases, lessees can elect not to recognize lease assets and lease liabilities. Instead, lessees can recognize lease payments on a straight-line basis over the lease term as an expense in the income statement. This practical expedient simplifies the accounting for short-term leases.

Key Differences from Finance or Operating Leases

- No Right-of-Use (ROU) Asset or Lease Liability: For short-term leases, the lessee is not required to recognize an ROU asset or lease liability on the balance sheet. This contrasts with finance and operating leases, where an ROU asset and corresponding lease liability are recorded.

- Expense Recognition: The lessee records the lease payments as lease expenses on a straight-line basis over the lease term. This simplifies the accounting, as there is no need for amortization of an ROU asset or interest expense calculation on the lease liability.

Example Scenario Setup

- Lease Term: 12 months (short-term lease)

- Monthly Lease Payment: $10,000

- Lease Classification: Short-Term Lease

Journal Entries

Since the lease payment is $10,000 per month and it is recognized as an expense, the journal entry each month is straightforward. The annual lease expense totals $120,000 (12 payments of $10,000).

Monthly Journal Entry

For each month, you would record the following:

Debit: Lease Expense $10,000

Credit: Cash $10,000

Annual Summary

If we summarize this for the year, the entry on an annual basis for reporting purposes would look like this:

Debit: Lease Expense $120,000

Credit: Cash $120,000

Amortization Table

Even though there’s no ROU asset or lease liability recorded, we can still create a table to show the monthly lease expense recognized over the 12-month period. In this case, each monthly payment is recognized as an expense immediately.

| Month | Lease Expense | Cumulative Lease Expense |

|---|---|---|

| Month 1 | $10,000 | $10,000 |

| Month 2 | $10,000 | $20,000 |

| Month 3 | $10,000 | $30,000 |

| Month 4 | $10,000 | $40,000 |

| Month 5 | $10,000 | $50,000 |

| Month 6 | $10,000 | $60,000 |

| Month 7 | $10,000 | $70,000 |

| Month 8 | $10,000 | $80,000 |

| Month 9 | $10,000 | $90,000 |

| Month 10 | $10,000 | $100,000 |

| Month 11 | $10,000 | $110,000 |

| Month 12 | $10,000 | $120,000 |

Summary

- Total Annual Lease Expense: $120,000

- Balance Sheet Impact: None, as there is no ROU asset or lease liability.

This treatment provides simplicity and reduces administrative burden for short-term leases while still aligning with ASC 842’s intent to enhance transparency in lease reporting.

ASC 842 Lease Disclosure Report

Lessee Name: [Lessee’s Company Name]

Reporting Period: For the year ending [Date]

1. Lease Summary

Lease Classification: Short-Term Lease

Lease Term: 12 months

Monthly Lease Payment: $10,000

Total Lease Expense for the Reporting Period: $120,000

2. Lease Disclosure Under ASC 842

Under ASC 842, [Lessee’s Company Name] has elected the practical expedient for short-term leases. The key implications of this election are as follows:

- No Right-of-Use (ROU) Asset or Lease Liability: As this lease qualifies as a short-term lease (12-month term or less) with the lessee's election to use the practical expedient, no ROU asset or lease liability is recognized on the balance sheet.

- Lease Expense Recognition: Lease payments are expensed on a straight-line basis over the lease term. Consequently, a monthly lease expense of $10,000 was recorded each month, resulting in a total lease expense of $120,000 for the reporting period.

3. Short-Term Lease Expense Recognition

| Month | Lease Expense |

|---|---|

| January | $10,000 |

| February | $10,000 |

| March | $10,000 |

| April | $10,000 |

| May | $10,000 |

| June | $10,000 |

| July | $10,000 |

| August | $10,000 |

| September | $10,000 |

| October | $10,000 |

| November | $10,000 |

| December | $10,000 |

| Total | $120,000 |

4. Additional Disclosure Information

Election of Practical Expedient: [Lessee’s Company Name] has elected the short-term lease practical expedient, which exempts the recording of an ROU asset and lease liability for leases with a term of 12 months or less.

Future Short-Term Lease Commitments: As of the reporting date, [Lessee’s Company Name] does not have additional short-term lease commitments extending beyond the lease term stated.

5. Balance Sheet Impact

Since this lease is classified as a short-term lease, there is no impact on the balance sheet. No ROU asset or lease liability has been recorded in relation to this lease.

Detailed Explanation of Each Section

Lease Summary

Purpose: This section provides basic details about the lease, including the classification as a short-term lease, the lease term, monthly payment, and total expense for the period.

Importance: It sets the stage for readers, helping them understand the nature of the lease and the financial commitment involved. The summary also highlights the annual lease expense, which aids in understanding the cost implications over the reporting period.

Lease Disclosure Under ASC 842