-

Month-End Close for Lease Accounting

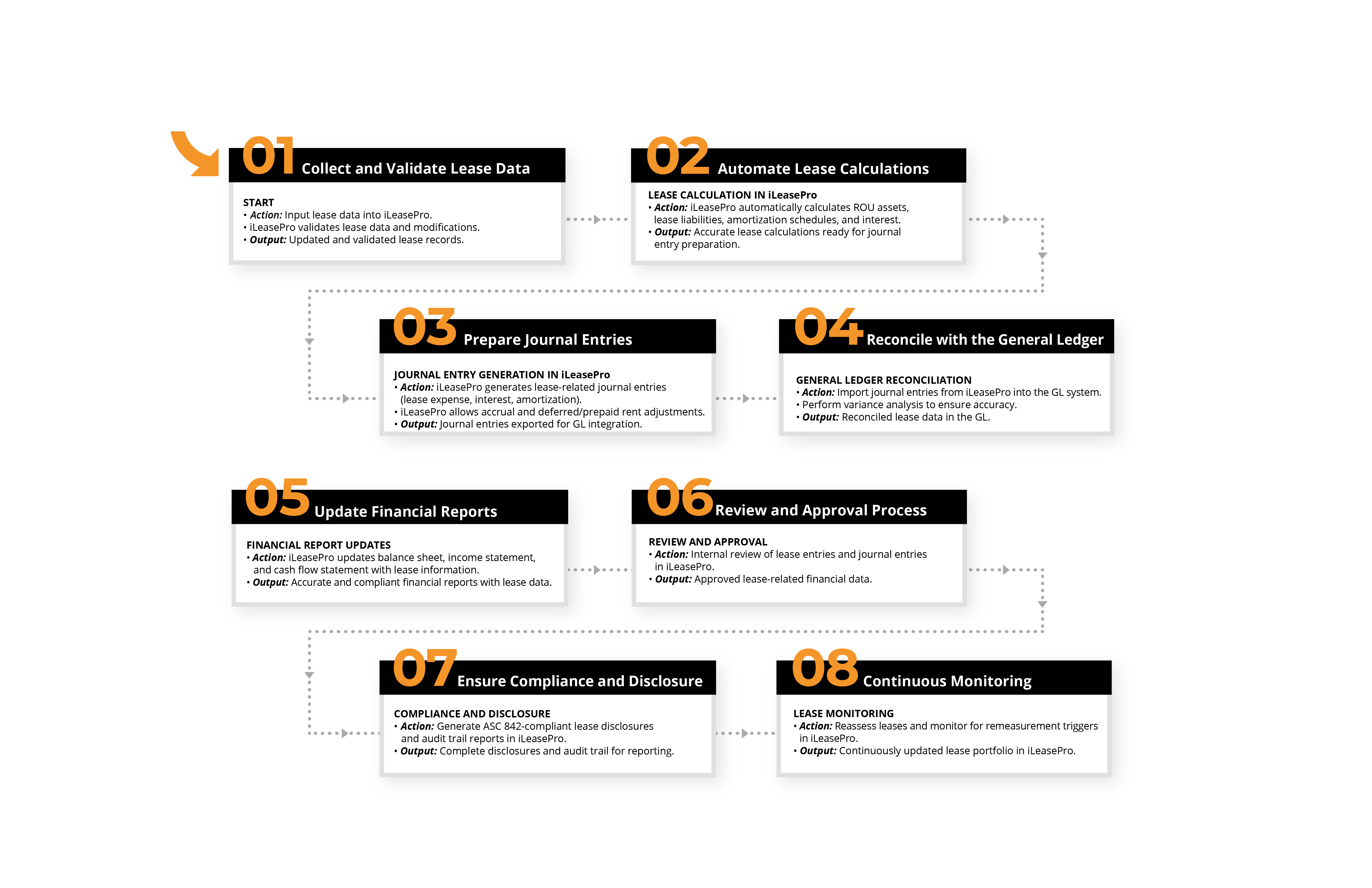

Integrating lease accounting into your month-end close process is crucial for maintaining accuracy and ensuring compliance with standards like ASC 842.

By leveraging iLeasePro, you can streamline this process, automate tasks, and reduce errors. Here's a step-by-step guide on how to integrate lease accounting into your month-end close, with specific ways iLeasePro helps along the way.

-

-

Step 1: Collect and Validate Lease Data

Action: Input all relevant lease data into iLeasePro, including new leases, modifications, terminations, or renewals, as required by ASC 842.

iLeasePro Functionality: The platform validates lease data, automatically tracks lease changes (e.g., modifications, reassessments), and ensures the data complies with ASC 842 standards.

Output: An updated, ASC 842-compliant lease database, ready for further calculations. -

Step 2: Automate Lease Calculations (ASC 842-Compliant Calculations)

Action: Use iLeasePro to automatically calculate Right-of-Use (ROU) assets and lease liabilities based on inputs like payment schedules, discount rates, and lease terms as required by ASC 842.

iLeasePro Functionality: The software computes the amortization of ROU assets and the interest on lease liabilities, ensuring compliance with ASC 842's detailed requirements.

Output: Accurate lease liability and ROU asset values, along with amortization and interest schedules, ready for journal entry creation. -

Step 3: Prepare Journal Entries (ASC 842-Compliant Journal Entries)

Action: Generate journal entries in iLeasePro to record the lease expenses, ROU asset amortization, and interest on lease liabilities.

iLeasePro Functionality: Automatically prepares all journal entries required under ASC 842, including adjustments for accruals, prepaid or deferred rent, and lease modifications.

Output: ASC 842-compliant journal entries exported for integration with your general ledger (GL) system. -

Step 4: Reconcile with the General Ledger

Action: Import/upload journal entries generated in iLeasePro into your GL system and reconcile lease-related transactions with the general ledger.

iLeasePro Functionality: Supports seamless GL account mapping, ensuring that all lease-related entries comply with ASC 842, including classifications for short-term and long-term liabilities.

Output: Reconciled, ASC 842-compliant lease entries in your GL. -

Step 5: Update Financial Reports (ASC 842-Compliant Reporting)

Action: Update your financial statements—balance sheet, income statement, and cash flow statement—to reflect lease-related assets, liabilities, expenses, and interest in accordance with ASC 842.

iLeasePro Functionality: Provides detailed ASC 842 data including ROU Asset Cost, Accumulated Amortization, Net ROU Asset, Current Lease Liability, Non-Current Lease Liability, Total Lease Liability, Remaining Lease Term, Remaining Lease Payments, Expense Amortization, Expense Interest, Expense Total, Weighted Average Discount Rate, and Weighted Lease Term.

This data updates your financial statements to reflect the proper classification of ROU assets and lease liabilities, and categorizes expenses (operating vs. finance leases) per ASC 842 requirements.

Output: Accurate and ASC 842-compliant financial reports. -

Step 6: Review and Approval Process

Action: Conduct an internal review of all lease-related journal entries and financial reports to ensure compliance with ASC 842 before finalizing the month-end close.

iLeasePro Functionality: iLeasePro’s review tools allow for a detailed audit of all lease-related data and calculations, ensuring accuracy and ASC 842 compliance before submission for approval.

Output: ASC 842-compliant, reviewed, and approved lease-related journal entries and financial statements. -

Step 7: Ensure ASC 842 Compliance and Disclosure

Action: Ensure proper ASC 842 disclosures are made in financial statements, including key details like lease classifications, total lease payments, and ROU asset amortization.

iLeasePro Functionality: Automatically generates the required ASC 842 lease disclosures, including all necessary financial statement notes and supporting schedules, while maintaining a complete audit trail for external review.

Output: Complete and ASC 842-compliant financial disclosures and audit documentation. -

Step 8: Continuous Monitoring (Ongoing ASC 842 Compliance)

Action: Continuously reassess leases in iLeasePro for changes that might trigger remeasurement or reclassification, as required under ASC 842.

iLeasePro Functionality: Tracks lease modifications, reassessments, and economic changes to ensure leases are correctly remeasured or reclassified under ASC 842 guidelines.

Output: Continuously updated, ASC 842-compliant lease portfolio, with automated remeasurement triggers and reclassification where necessary.

Implementing iLeasePro for Enhanced Compliance

iLeasePro Key Benefits

Streamlined Accounting with Limited Resources: iLeasePro simplifies the lease accounting process, allowing your company to stay compliant with ASC 842 standards without the need for specialized accounting staff, saving both time and money.

Manage Complex Lease Portfolios with Ease: Whether managing real estate, equipment, or vehicle leases, iLeasePro helps you easily classify, organize, and track your diverse lease portfolio, no matter the complexity or asset type.

Ensure Compliance Across Multiple Locations: iLeasePro provides centralized lease management, ensuring consistency and compliance with ASC 842 across all branches and locations, allowing seamless oversight from a single platform.

Group-Specific Financial Tracking: With iLeasePro, you can monitor lease costs at the group level, providing clear insights into how leases impact individual programs or initiatives, allowing for more accurate financial planning and reporting.

Accurate Lease Classification: The iLeasePro Classification Wizard automates the process of classifying your leases as operating or finance leases, ensuring compliance with ASC 842 and simplifying your financial reporting process.

Seamless Management of Lease Modifications and Renewals: Easily manage lease modifications, renewals, and remeasurements with iLeasePro’s intuitive platform, ensuring your organization remains compliant with evolving lease agreements.

Affordable Automation for Lease Accounting: iLeasePro provides an intuitive and cost-effective solution for automating your lease accounting, reducing manual errors and saving your nonprofit valuable resources without breaking the budget.

Enhanced Transparency and Accountability: iLeasePro ensures accurate, real-time reporting for all stakeholders, allowing your company to maintain the highest levels of financial transparency and accountability.

Audit-Ready Financial Reporting: With iLeasePro, your lease data is organized and compliant, making your company audit-ready and ensuring that external reporting is accurate, complete, and easy to navigate during reviews or audits.

-

Let iLeasePro Help You in Your Lease Accounting Journey

Navigating ASC 842 compliance is a substantial but manageable task, especially with the right tools and strategies in place.

By integrating structured lease management and comprehensive lease analysis via iLeasePro, your company can not only meet compliance requirements efficiently but also gain strategic advantages through enhanced lease portfolio management.

Implement these steps to streamline your processes, pass audits confidently, and unlock financial improvements.

To do this, call us at 888-351-4606, or you can email us at info@ileasepro.com. We also have plenty of great information about lease accounting software on our website at iLeasePro, and you can chat with a live representative there as well.