Understanding ASC 842 with an Example Scenario

See how the ASC 842 will change your financial reporting

The ASC 842 Lease Accounting Standard was

introduced by the Financial Accounting Standards Board (FASB) to establish new guidelines for lease accounting.

Understanding how to build an ASC 842 Lease Accounting amortization schedule and record ASC 842 Lease Accounting

journal entries is crucial for accurately reporting lease transactions. In this blog, we will walk through an ASC

842 Lease Accounting example transaction and guide you on the ASC 842 amortization schedule, how the the income

statement and balance sheet are recorded, the ASC 842 journal entries that are created and the ASC 842 Disclosure

Reporting data.

ASC 842 LEASE ACCOUNTING EXAMPLE

This example transaction does not

take into account many of the more complex and subjective areas of the ASC 842 dealing with subjects such as lease

renewal options, contingent rents, residual value guarantees and term option penalties.

Let's consider a

hypothetical scenario where your company, ABC Marketing, leases office space for a term of 6 years and transitions

to the ASC 842 standard with 4 years remaining on the lease term.

Assumptions

- A six-year non-cancelable lease term: 72 months

- Commencement Date:1/1/2020

- Expiration Date: 12/31/2025

- Transition Date: 1/1/2022

- Minimum monthly lease payment: $5,000

- Assuming there are no defined lease options, contingent rental payments or residual value guarantee.

- We are not accruing any interest on prepayments or advances received before commencement or accrued IDC.

- Rent Payments are made on the first of each month.

- Incremental borrowing rate: 7%

- Transitioned to the ASC 842 on 1/1/2022

- Specified as an Operating Lease

Calculated Amounts

Present Value (PV)

of lease payments = $210,873

Total lease payments over the 48 month term = $240,000

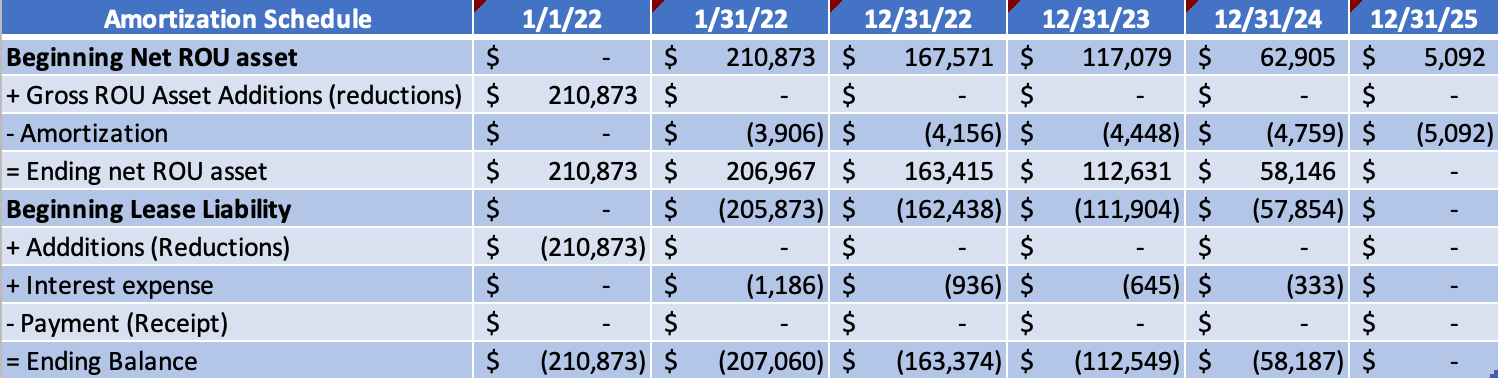

ASC 842

Amortization Schedule

Building an ASC 842 Amortization Schedule from an example lease

Accounting entries under the ASC 842 model would be as follows:

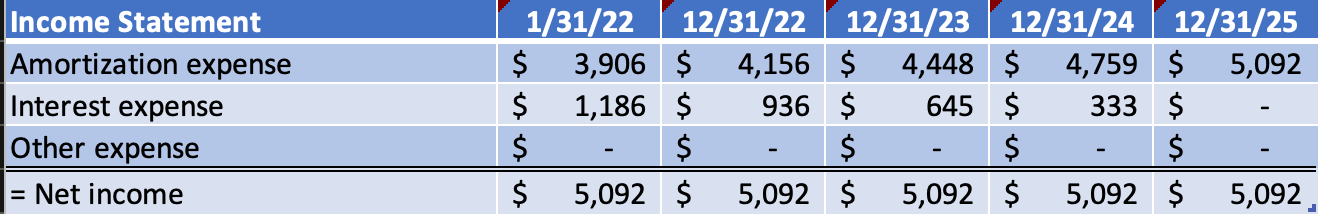

Income Statement for an example lease under the ASC 842

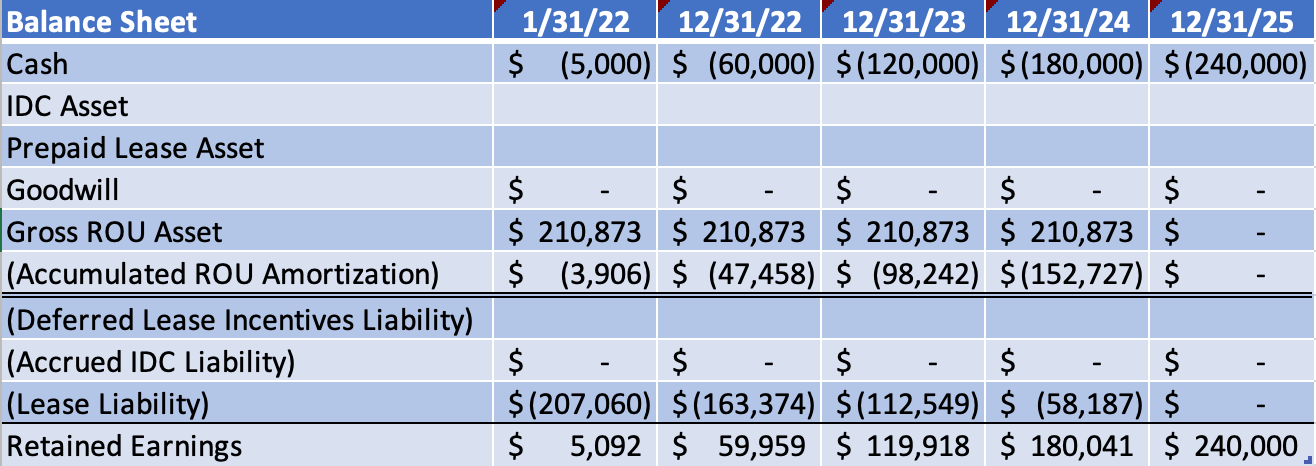

Showing how a balance sheet is changed under the ASC 842 Lease Accounting Standard

ASC 842 Lease Accounting Journal Entries

| End of Period 2022 | ||

| Cash | $ - | $ 60,000 |

| Gross ROU Asset | $ 210,873 | $ - |

| Lease Liability | $ 60,000 | $ 223,374 |

| Rent Expense Implied Interest | $ 12,501 | $ - |

| Rent Expense Implied ROU Amortization | $ 47,458 | $ - |

| ROU Asset Accumulated Amortization | $ - | $ 47,458 |

| End of Period 2023 | ||

| Cash | $ - | $ 60,000 |

| Lease Liability | $ 60,000 | $ 9,176 |

| Rent Expense Implied Interest | $ 9,176 | $ - |

| Rent Expense Implied ROU Amortization | $ 50,783 | $ - |

| ROU Asset Accumulated Amortization | $ - | $ 50,783 |

| End of Period 2024 | ||

| Cash | $ - | $ 60,000 |

| Lease Liability | $ 60,000 | $ 5,638 |

| Rent Expense Implied Interest | $ 5,638 | $ - |

| Rent Expense Implied ROU Amortization | $ 54,485 | $ - |

| ROU Asset Accumulated Amortization | $ - | $ 54,485 |

| End of Period 2025 | ||

| Cash | $ - | $ 60,000 |

| Gross ROU Asset | $ - | $ 210,873 |

| Lease Liability | $ 60,000 | $ 1,813 |

| Rent Expense Implied Interest | $ 1,813 | $ - |

| Rent Expense Implied ROU Amortization | $ 58,146 | $ - |

| ROU Asset Accumulated Amortization | $ 210,873 | $ 58,146 |

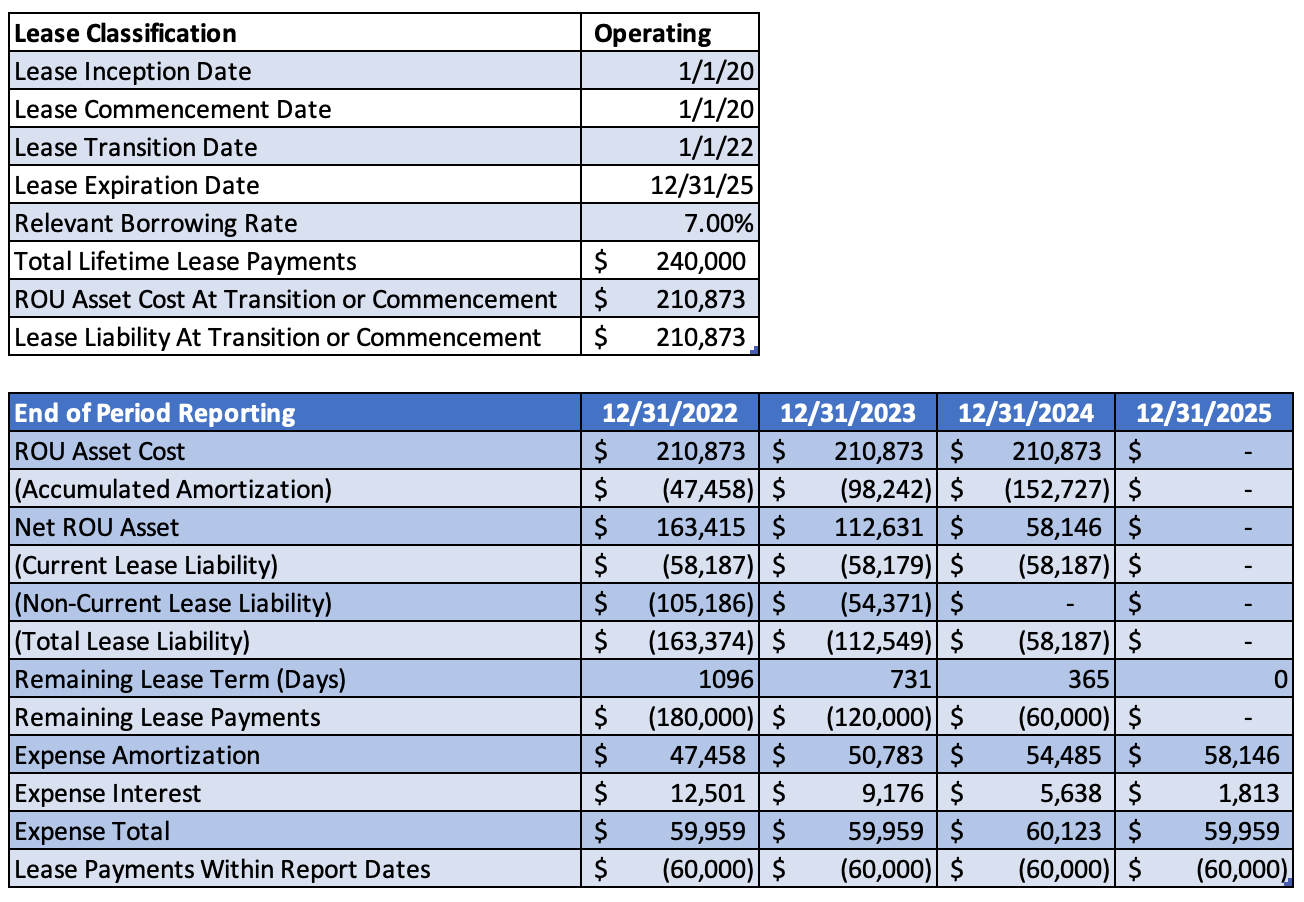

ASC 842 Lease Accounting Disclosure Reporting Data

Example financial disclosure data under the ASC 842 Lease Accounting Standard

In addition to the reporting changes to the balance sheet and Income Statement identified above, firms should evaluate the impact to;

- Current accounting processes

- Lease Accounting system/software

- Income tax impact

- Financial Ratios

- Increase in EBITDA

- Return on Assets

- Debt-to-Equity

- Interest Coverage

- Operating Margins

- Debt covenant compliance

- Ability to secure financing

- Integrity of lease information

- Resources required