NPV vs. XNVP: Choosing the Right Method for ASC 842 Lease Accounting

Net Present Value in Lease Analysis

Before we get into Net Present Value (NPV) and Extended Net Present Value (XNPV) in lease accounting and lease

analysis, let's

break down the concept of present value (PV) and its application in lease accounting and analysis.

The

present

value plays a foundational role in generating a lease amortization schedule. An amortization schedule breaks down

each

lease payment into two components: interest expense and reduction of the outstanding lease liability. It provides a

clear picture of how the liability changes over the lease term. The starting point is the present value of future

lease

payments. This value represents the initial lease liability. Essentially, this is the amount the lessee owes at the

commencement of the lease.

A lease amortization schedule offers a clear view of how each lease payment is

allocated between interest and principal. Using the present value of future lease payments as the starting point,

the

schedule provides a chronological breakdown of the lease liability's reduction over the lease term. This allows both

lessees and lessors to track and account for the financial aspects of the lease accurately.

Present value

(PV) is

the current worth of a future sum of money or stream of cash flows given a specified rate of return. It provides a

means

to determine how much a future cash flow is worth today. The underlying principle is the time value of money, which

posits that a dollar today is worth more than a dollar in the future because of its potential earning

capacity.

Present Value in Lease Accounting

Present value plays a pivotal role in

lease

accounting for several reasons:

a. Lease Liability Recognition: Under modern accounting standards like ASC

842

and IFRS 16, lessees are required to recognize a liability for future lease payments on their balance sheets. This

liability is calculated as the present value of expected future lease payments. By discounting these future payments

to

their present value, companies can represent their true financial obligation as of the balance sheet date.

b.

Right-of-Use Asset (ROU): Alongside the lease liability, lessees also recognize a right-of-use asset on their

balance

sheet. It's initially measured at the amount of the lease liability, adjusted for any lease payments made at or

before

the lease commencement date, plus any initial direct costs incurred. The ROU asset's initial recognition is

intrinsically linked to the present value of future lease payments.

c. Classification of Leases: The present

value of future lease payments, in comparison to the fair value of the leased asset, is one of the criteria used to

classify a lease as either an operating lease or a finance lease. For example, if the present value of lease

payments is

substantially all of the fair value of the leased asset, it may be classified as a finance

lease.

Present

Value in Lease Analysis

Beyond accounting, present value is also a key tool in lease

analysis:

a. Lease vs. Buy Decisions: By comparing the present value of future lease payments with the

present

value of purchase or financing costs, businesses can evaluate the financial advantages of leasing versus buying an

asset.

b. Lease Contract Comparisons: When assessing multiple lease options, calculating the present value of

each option's expected payments can provide a clearer comparison of their costs.

c. Evaluating Lease

Renewals:

When lease agreements are up for renewal, businesses can use present value to assess the financial implications of

renewing the lease versus seeking alternative arrangements.

Present value is a cornerstone concept in finance

and

is especially crucial in lease accounting and analysis. By discounting future obligations or benefits to their

current

worth, businesses can make informed decisions, ensure accurate financial reporting, and provide stakeholders with a

transparent view of their financial position.

NPV and XNPV - How Do We Calculate Present

Value?

Both NPV and XNPV are tools to calculate the present value of future cash flows, but they

are

best suited for different scenarios:

- NPV is best for cash flows at regular intervals.

- XNPV is ideal for cash flows occurring at irregular intervals.

In essence, when you're computing NPV or XNPV, you're calculating the present value of a series of future cash

flows. The difference lies in the regularity of these cash flows and how they are discounted to the

present.

In

the context of lease accounting, especially when evaluating irregular cash flows or payment schedules, it's often

more

accurate to use the XNPV function over the traditional NPV. Here's why:

Difference Between NPV and

XNPV

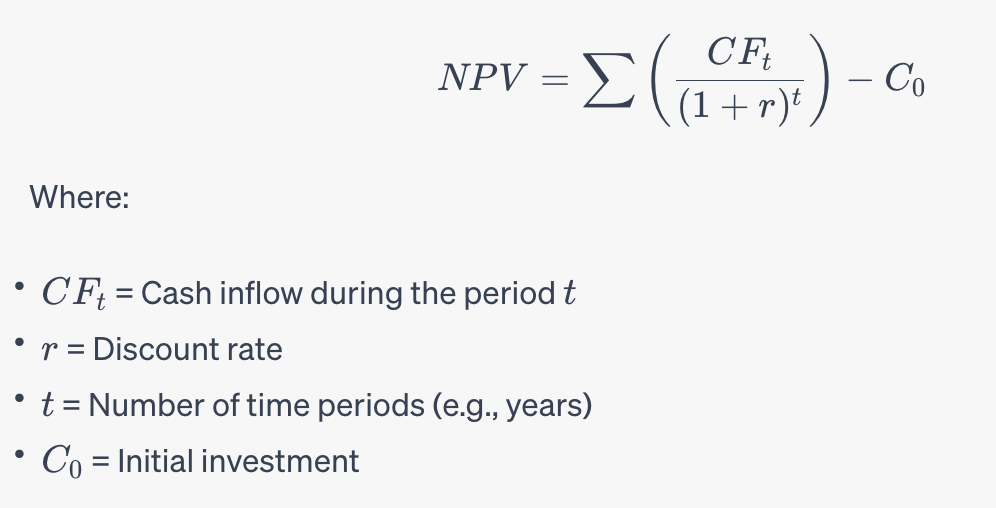

NPV (Net Present Value): The traditional

NPV

function assumes a consistent series of cash flows at regular intervals, such as annually, quarterly, or monthly.

The

formula for NPV is:

Net Present Value NPV

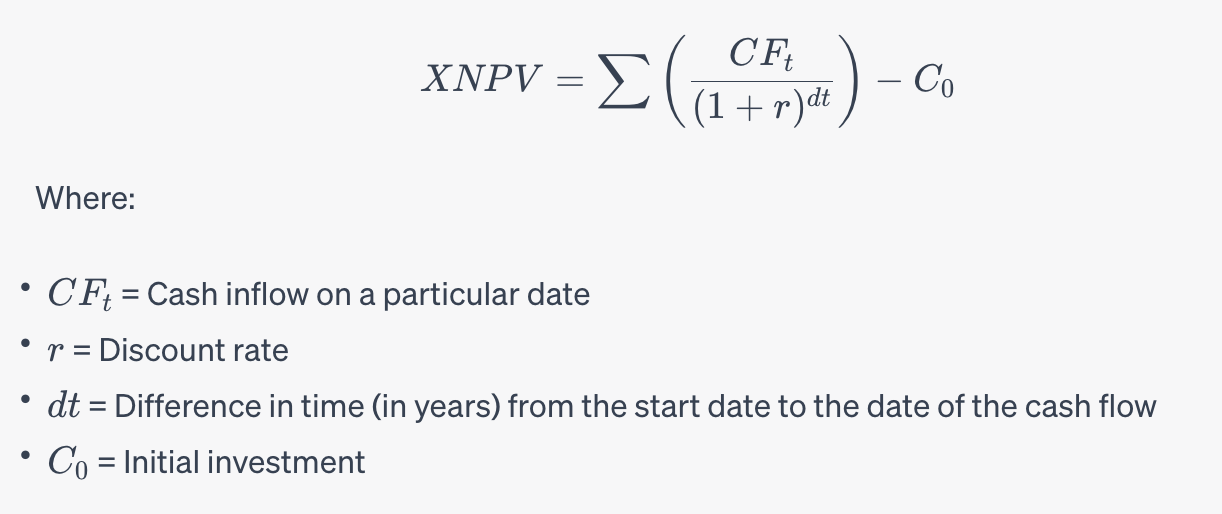

XNPV (Extended Net Present Value): The XNPV function, on the other hand, allows for cash flows at irregular intervals. It discounts cash flows based on the actual date of each cash flow, making it more versatile. The formula for XNPV is:

Why Use XNPV Over NPV in Lease Accounting and Lease Analysis?

1. Irregular Payment Schedules: Leases might have irregular payment

schedules. For instance, there might be upfront payments, variable lease payments based on usage, or uneven payments due

to renegotiations. XNPV can accommodate such irregularities by taking the exact payment dates into account.

2. Accuracy: Since XNPV considers the exact date of each cash flow, it

provides a more accurate present value, especially when dealing with leases that don’t have a standard payment

structure.

3. Flexibility: Lease agreements might include

specific clauses that can lead to variable payments, such as contingent rents based on performance metrics or inflation

adjustments. XNPV can easily handle such variability.

4. Comparative

Analysis: When comparing multiple lease options with different payment structures and timelines, XNPV offers

a more apples-to-apples comparison.

5. Conformity with ASC 842:

Modern lease accounting standards like ASC 842 require a more detailed and precise calculation of lease liabilities.

Given the nature of these standards and the emphasis on transparency and accuracy, XNPV can be a more appropriate tool

to ensure compliance.

While the traditional NPV function is suitable for standard cash flow structures with

regular intervals, the complex nature of many lease agreements necessitates a more detailed approach. The XNPV function,

with its ability to handle irregular cash flows and payment dates, provides lease accountants with the precision and

flexibility needed to accurately represent the present value of lease liabilities. iLeasePro uses XNPV in its

calculations!

Navigating ASC 842 in Lease Analysis

An essential aspect that stakeholders in leasing — whether it’s commercial real estate, equipment, fleet vehicles, or oil & gas — must consider is the ASC 842 lease accounting standard. Implemented by the Financial Accounting Standards Board (FASB), ASC 842 necessitates organizations to recognize leases on their balance sheets, bringing transparency to previously off-balance sheet leasing activities. This standard has a profound impact on financial reporting and requires lessees to recognize assets and liabilities for most leases. As you embark on your leasing journey, ensuring compliance with ASC 842 not only safeguards against potential financial discrepancies but also fortifies your organization’s credibility in financial disclosures. Partnering with iLeasePro can streamline this process, ensuring that your lease analysis is both strategic and compliant.